Online Billing Software

Billing and invoicing are two of the most important components of a businesses' process. We help you find the right tools for the job by testing the top 10 solutions in the category. Choosing the best online invoice software is quite a challenging task for any organization, and it is beneficial for managers to be aware of all potential issues that they may face with invoice billing software systems. No online billing software in India is an impenetrable fortress, so it is better for managers to know about any kinds of. Easy & Fast Complete Billing Platform. Making Recurring Billing Hassle-Free! We, at OneBill, offer the perfect software to deal with your invoicing, inventory, accounting needs. Our simple invoice software is designed to allow you to reduce your overall invoicing processing time and improve customer service. Billing and invoicing needs differ significantly from one company to the other, but what is very common in the corporate environment is to look for billing software that eliminates manual entries and automates routine operations to cut time consumption. Zoho Invoice is a billing and invoice software that lets you craft and send beautiful invoices to your customers. With its advanced features and easy-to-use interface, Zoho Invoice is the best invoicing partner for freelancers and small business owners. Radekal Expeditor is a game changing medical billing software designed to increase productivity and revenue by at least 30%. Learn more about Radekal Medical Billing. Radekal Expeditor is a game changing medical billing software designed to increase productivity and revenue by at least 30%. Learn more about Radekal Medical Billing. Invoicely is free online invoicing for small businesses. Create and send invoices and estimates, track time and expenses and accept online payments.

- Free Simple Billing Software

- Online Billing Software For Retail Shop

- Online Billing Software Companies

- Gujarat Pds Shop Online Billing Software

Free Simple Billing Software

Easier Ways to Pay

Billing and reminding customers to pay their bills is probably one of the most unsavory aspects of doing business, but it is necessary and critical to keeping businesses profitable. Great billing and invoicing solutions can take away a lot of the pain points of the process while adding more options for receiving payments, as well as speeding up billing tasks. These solutions help you add more electronic payment channels and mobile payment networks that can make paying quicker and easier for your customers. Other products specialize in keeping up on billing and invoicing tasks. Let's take a look at the best options we've tested.

The type of business you run as well as the clients you have will all factor into your choice of the right billing and invoicing solutions. Retail operations live on cash and credit payments, while services-based businesses and freelancers have particular needs and can work with online payment solutions.

For small to midsize businesses (SMBs), the ability to articulate the services rendered as well as the payment options and timing in a professional way is critical to getting paid quicker. Being able to juggle tax information, create receipts, expense accounts, as well as automate follow-up notices, are valuable features for SMBs.

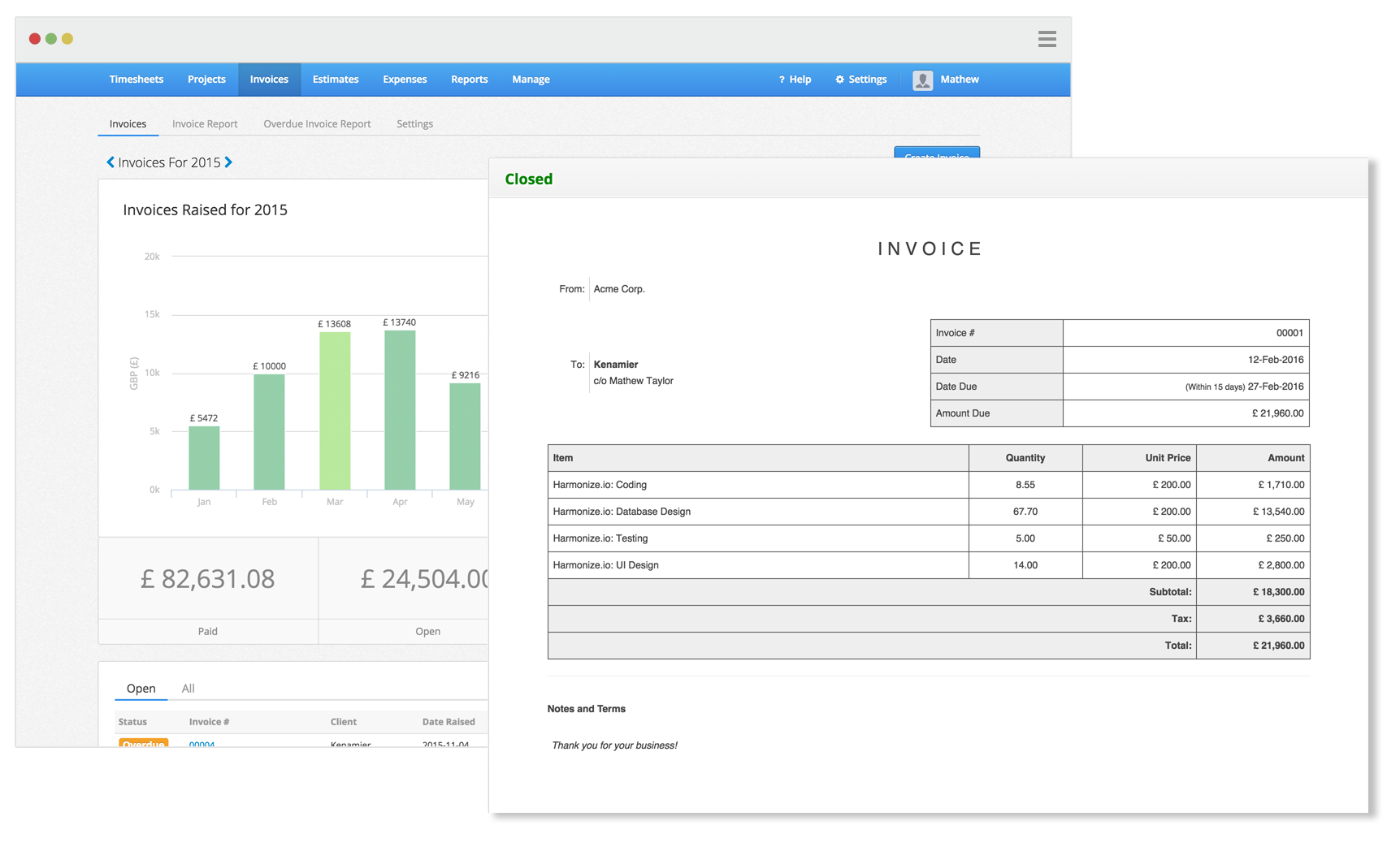

This is where billing and invoicing software comes in. This software gives you the means to track your sales or services rendered, who was billed, the fees or charges applied, and when payment was received (or when it was supposed to be received but wasn't). It also gives you a data path to record all of that data in your other accounting and bookkeeping systems. In accounting terms, this workflow is part of Accounts Receivable. And while many smaller businesses still maintain these kinds of records and prepare invoices using a spreadsheet or word processing application, there are plenty of specialized software apps that let you perform the task quicker, more easily, and with much less effort. Best of all, many of them are inexpensive or even free to use.

In our reviews, we examined standalone invoicing and billing systems. We also took a deeper look into the billing capabilities of some more comprehensive accounting systems in which the billing process is just a part. These systems also include the data for business purchases, inventory management, and general ledger accounting. All of the billing and accounting systems we reviewed are delivered as Software-as-a-Service (SaaS) apps that are located in the cloud rather than locally installed. Therefore, all you need is a web browser and you're in business.

More Than Just Sending a Bill

Many of the billing systems we reviewed let you enter and record the initial sales transaction, which is a good place to start the billing process. In accounting terms, this is called 'Sales Order Entry' or simply Order Entry. Even if you're just looking to send out a bill and receive payment, you still need to look at the Order Entry part of the system and determine how it will work with the kind of business you're operating.

Most full-blown accounting systems and a number of billing systems have an 'Order Entry of Sales' front end where you can key in the items or services for which you want to bill. For the most part, these items or services need to be defined before you can use the sales front end. With most accounting systems, Sales integrates with Inventory so that it will be the point at which items and prices get defined. With a simpler billing system, you'll have to create these items, descriptions, and prices as a separate process. Taxes, such as Sales Tax or Value Added Tax (VAT), is another place at which billing-oriented systems differ from more robust accounting ones. Many accounting systems provide tax tables that will automatically calculate the requisite sales tax, or they will integrate with a tax service app

Actually creating the bill is another consideration. Many of the billing apps and subsystems we examined let you create a bill on the fly by using a mobile app. This is a great feature if you want to be able to create a bill at the time of sale or immediately when a service is provided while you're at a customer's location. The ability to email that bill or invoice is another desirable feature for many users, as is automatically creating bills for recurring charges every month or according to some other regular time period.

Many of the apps we looked at also included more advanced capabilities that might apply to your particular operation. These include the ability to handle multiple currencies for those businesses that operate in more than one country, or pop-up timers if you bill by the hour. Keep in mind, however, that we looked at billing and invoicing apps, not time tracking or expense tracking software—each of which has a different target audience.

Something else to keep in mind is that, while the terms 'invoice' and 'statement' are used interchangeably occasionally, they're actually not the same thing. An invoice may have multiple itemized charges and services listed on

Tracking Cash Flow

Another area that's important to consider when selecting billing software is how you will get paid. For many years, accepting cash or checks were your only alternatives, especially for small businesses. That's far from true these days. Credit cards especially are considered a must-have payment option even for small businesses. Fortunately, billing platforms incorporate the ability to accept credit cards. There's always a charge for this, which is usually a percentage of the transaction as well as a per-transaction or monthly fee. You'll need to read this fine print carefully as this charge can be on top of the percentage fee charged by the actual credit card processor. You need to decide whether this kind of charge is worthwhile. In many cases, having access to the payment more or less immediately is well worth the charge, which is deductible from revenue as a business expense in any case. Some software vendors can also provide a customer portal where your customers can pay their invoices electronically through a wire transfer or

Online Billing Software For Retail Shop

Finally, there's reporting. Good reporting capabilities are always something you should seek out and billing software is no exception. Most users, especially smaller businesses, won't need dozens of reports. But you will want to know which bills are past due and how long past due they are. You will also want to be able to see your revenue flow at any point in time. You'll want to have the capability of sending customers Past Due notices and reminders when necessary. Effectively managing your cash flow is a primary reason for using an invoicing app.

Online Billing Software Companies

Last but not least, and related to reporting, is the ability to integrate your billing system with your back-end accounting system. There's a lot of competition to Intuit Quickbooks these days, so even small businesses need to make sure their billing system and accounting system can effectively talk with one another. If they don't, then these businesses could wind up doing a lot of unnecessary manual entry.

Gujarat Pds Shop Online Billing Software

The apps we tested can provide multiple options for invoice templates. Customization comes by way of adding your company log, specific font or branding identity artwork as well as defining the fields to suit your company and your customer's needs.

Featured Billing and Invoicing Software Reviews:

Wave Review

MSRP: $19.00Pros: Free, though payments and payroll incur fees. Smart selection of features for very small businesses. Excellent invoice- and transaction-management. Good user interface and navigation tools. Multicurrency. Payroll.

Cons: No dedicated project- or time-tracking features. No comprehensive mobile app.

Mar 29, 2019 This page contains a list of cheats, codes, Easter eggs, tips, and other secrets for Insaniquarium Deluxe! If you've discovered a cheat you'd. Insaniquarium deluxe hacked. Insaniquarium Deluxe v1.0 Hacked. Game & Hack Information. Oct 29, 2008 44151 Plays Strategy 6.65 MB. Hacked By: mathewthe2. Hack Information: money, shells, unlocked the levels (max level: 5) Game Information Feed your fish! If you feed your fish well they will give you money!

Bottom Line: Wave is priced like a freelancer accounting application (it's free) and it's an excellent service for that market, but it also offers enough extras that a small business with employees could use it-with some caveats.

Read ReviewZoho Invoice Review

MSRP: $0.00Pros: Customizable invoice templates. Multi-currency support for billing global clients. Ample time tracking and timesheet features.

Cons: Inability to integrate with Zoho Inventory is a head scratcher.

Bottom Line: Zoho Invoice provides small to midsize businesses (SMBs) with a versatile and intuitive billing solution. Works well as a standalone app but also integrates nicely into the larger ecosystem of Zoho business products.

Read ReviewBQE Core Review

MSRP: $7.95Pros: Affordable, modular pricing for stand-alone time tracking. Vast reporting. Excellent customization.

Cons: Pricing can become expensive as modules are added. No GPS tracking in Android. No IP restrictions. No dial-in clock-in.

Bottom Line: With BQE Core, small to midsize businesses (SMBs) get a solid time tracking tool that also serves as a billing and invoicing app.

Read ReviewFreshBooks Review

MSRP: $15.00Pros: Freshbooks offers a delightful user experience that enable freelancers and SMBs to quickly invoice customers and get paid faster. Team collaboration tools, time tracking, and estimate functionality are great add ons.

Cons: Poor reporting functionality, limited features in the estimates tool. Late Fees feature could use more options.

Bottom Line: FreshBooks offers a well-rounded and intuitive time tracking, online accounting, and invoicing solution that anticipates the needs of freelancers and small businesses.

Read ReviewXero Review

MSRP: $30.00Pros: Affordable. Thorough record and transaction forms. Approval levels. Inventory tracking. Customizable reports. Online quotes. Smart Lists. Updated expense tracking. Exceptional online support.

Cons: Payroll not available for all states. Time tracking still in beta. Lacks phone and chat help. Weak mobile apps.

Bottom Line: Double-entry accounting app Xero excels at inventory management, payroll, and many other functions critical to keeping the books of a small business.

Read ReviewAnd Co Review

MSRP: $0.00Pros: Aimed at freelancers and creative studios. The app is free. Moderate customization of invoices. Includes timer. Can create a detailed contract or proposal.

Cons: Support is through an app Chat function that does not operate on weekends.

Bottom Line: And Co by Fiverr is a solid invoicing tool aimed primarily at freelancers. It's good for its target market, though it'll have some stringent limitations for folks who need more features from their billing system.

Read ReviewBilly Review

MSRP: $15.00Pros: Excellent user experience and dashboard. Double-entry accounting. Easy to establish different sales taxes. Supports both quotes and estimates.

Cons: Some operations involve dealing with debits and credits. No timer or dedicated time-tracking. Few reports. No full mobile app. Only one third-party add-on.

Bottom Line: Billy's combination of tools and usability make it a good choice for freelancers and sole proprietors who need to track income and expenses and invoice customers. It doesn't offer a lot of reports or third-party add-ons, however.

Read ReviewIntuit QuickBooks Self-Employed Review

MSRP: $10.00Pros: Exceptional user interface and navigation. Easily tracks expenses and income. Automatic mileage tracking. Can assign business transactions to Schedule C categories. Estimates quarterly income taxes. OCR capability.

Cons: Lacks direct integration with e-commerce sites. No data records, time tracking, project tracking, or recurring transactions. Invoices not customizable or thorough. No estimates or sales tax.

Bottom Line: The simplicity of online accounting service QuickBooks Self-Employed may make it a good fit for some freelancers and independent contractors, but others will miss standard features like time tracking, project tracking, and estimates.

Read ReviewInvoicely Review

MSRP: $29.99Pros: Wealth of features even at the lowest paid tier. Supports multiple countries and currencies. Useful reports.

Cons: No custom branding for free version. Invoice customization could be better. Time and mileage tracking are minimal.

Bottom Line: Invoicely is a strong contender in the billing space. It is lacking customization features, but it has strong reporting and currency support functionality.

Read ReviewInvoice2Go Review

MSRP: $19.00Pros: Easy to use and understand. Invoice open notifications. Affordable.

Cons: Features are limited in cheapest edition. Lacks optical character recognition (OCR). Confusing billing structure.

Bottom Line: Invoice2Go is a decent billing and invoice application with a lot to like, but having its full range of features will cost you.

Read Review